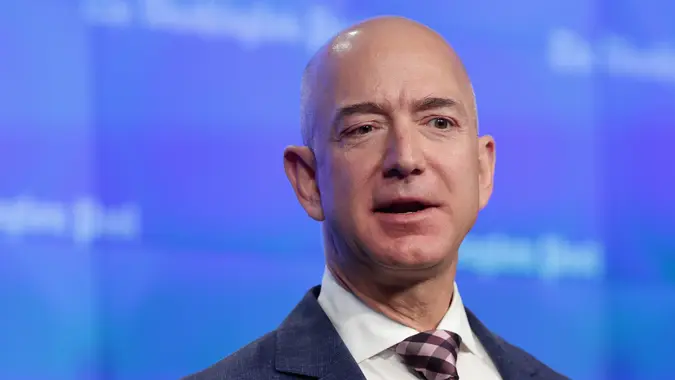

Industrialist Andrew Carnegie famously said, “Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined.” Jeff Bezos knows this — it’s why he backed the fractional property investing platform Arrived.

So why do the wealthy love real estate so much? Here are seven reasons why wealthy people love to invest in real estate.

Cash Flow

As an asset class, real estate does an exceptional job of generating cash flow. In some cases, more than half of the total returns come from ongoing income — income that you can potentially live on. It’s no surprise that passive real estate income constitutes a significant portion of many millionaires’ and billionaires’ total income.

Financial advisor Kevin Chancellor of Black Lab Financial Services has seen this many times among wealthy clients. “Whether you are a billionaire or a mom-and-pop property owner, real estate is an outstanding income-producing asset.”

Cash flow from real estate almost always improves over time as well. You pay for the property once and then collect “forever income” that rises every year along with inflation (more on that shortly).

Appreciation

In addition to generating income, real estate typically appreciates over time.

Sometimes, this happens slowly, inching up one to three percent in a year. At other times, property values skyrocket at many times that pace.

Either way, real estate helps grow your net worth over time — the name of the game in building wealth.

Leverage

When you buy real estate, you can do so with (mostly) other people’s money.

“Real estate is an unfair asset class because of the tax breaks, the appreciation, and the leverage involved,” explained Bronson Hill, founder of Bronson Equity. “This is the reason why wealthy people have used it for hundreds of years.

“Real estate leverage is incredible. It allows a 20% increase in the property value to create a 100% return on your capital investment if you put down 20% of the purchase price. The unfair advantage of using leverage is using other people’s money — the bank’s money — to have more upside with less risk to your own money than buying with cash.”

Passive and Active Investing Options Available

“Real Estate gives flexibility to an investor because he or she can choose to be an active property buyer or a passive investor and still receive income streams,” said Chancellor.

Anyone who wants to start a business but doesn’t know what type of business to launch can start with tried-and-true real estate business models. A few options include real estate wholesaling (flipping contracts), flipping houses, flipping land, land wholesaling, property management, and dozens of other business models.

You can also build a side business around investing in rental properties. Just don’t expect it to be passive — it takes much more work to find, fund, buy, renovate, manage and maintain rental properties than the average person realizes. Landlording is a part-time job, not a source of passive income.

Even so, you have plenty of options to invest passively in real estate. That could start with real estate crowdfunding platforms, but if you want to get into real returns, learn how to invest in private equity real estate syndications like the wealthy. Fortunately, you don’t have to be wealthy to invest — find a passive real estate investing club to join in on these fractional investments with other investors.

You could also invest in REITs, of course, but beware that they don’t offer much diversification benefit.

Diversification

Real estate shares a low correlation with stock markets, making it an ideal way to diversify your portfolio.

The stock market can crash, rebound, and gyrate all over the place, even as your real estate income keeps flowing. “It adds another level of diversification that is not correlated with the markets,” added Chancellor. “And you have multiple options for real estate investing that allow for short, intermediate, and long-term investment options depending on how it fits into a portfolio.”

Even within the realm of real estate, you can diversify across many property types and cities. Invest fractionally in industrial properties, multifamily apartment complexes, retail properties, office buildings, and even mobile home parks, marinas, or farmland. One sector might struggle as turbulence hits that industry, but that doesn’t mean it will impact your other investment types.

Tax Advantages

From maintenance to travel to loan interest, every conceivable expense is deductible for real estate owners. You can even write off some “paper costs” such as depreciation.

In many cases, you show a loss on your tax return, even as you collect cash flow in real life. That’s the power of real estate in your portfolio.

Inflation Protection

Currency values shift over time, but people still need shelter, restaurants still need a physical location to serve guests, and doctors still need medical offices to see patients.

That means they’ll pay the going rate, whatever the value of the currency.

In fact, rents are one of the primary drivers of inflation, not the other way around. Since 1980, rents have risen 1.27% faster than inflation in the U.S.

You don’t need to be a millionaire (much less a billionaire) to invest in real estate, even private equity real estate.

With $10, you can start investing in some real estate crowdfunding platforms like Groundfloor and Fundrise. With $100, you can buy fractional shares in rental properties on Ark7 or the Bezos-backed Arrived. With $5,000, you can join private equity real estate syndications with other investors through a passive real estate investment club to start targeting returns in the mid-teens or higher.

The rich love real estate for good reasons. Consider taking a page out of their book to build your own recession-resistant, income-producing portfolio.